As uncomfortable as it might be to think about what will happen when you’re no longer around, it’s important that you do the best you can to take care of those you leave behind. Life insurance might seem like something you don’t need to plan for or count on until you’re a little older; however, that couldn’t be further from the truth. You should get coverage now in order to protect your family later.

Researching different policies can be confusing for many; there are so many options to choose from with vast differences. The policy you choose will depend on your current financial situation, whether others are financially dependent on you or not and so many other factors.

Your Life Insurance Options

Your Life Insurance Options

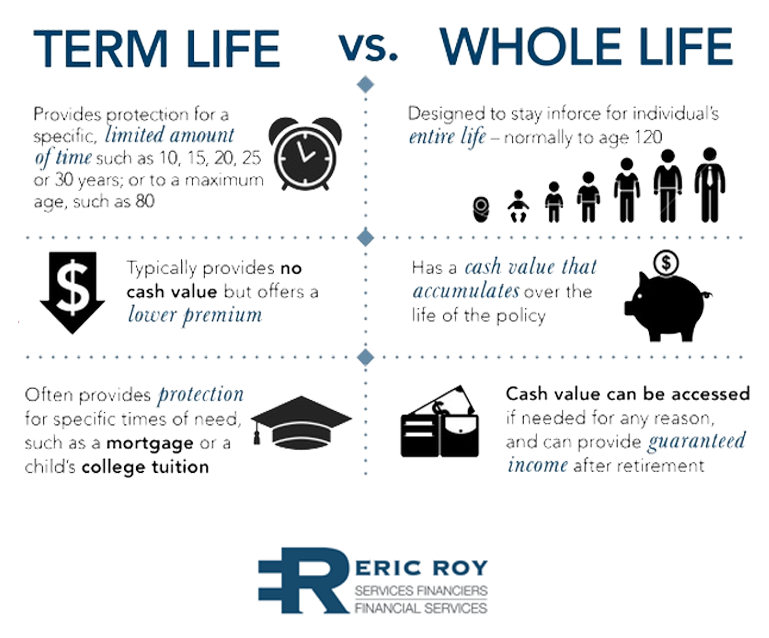

There are two types of life insurance: temporary and permanent. That part’s pretty simple. But understand the differences between these two categories and the respective subcategories is where the details matter. So let’s break it down to find out which is right for you.

Term Life:

Is a temporary policy for a set period of time (i.e. 5 years, 10 years or 20 years). Once it expires there’s usually a renewal option to continue with a term life policy or switch to one of the permanent life insurance policies. This is a cost-effective way to have basic life insurance to cover funeral costs and small debts you may owe.

Whole Life:

A permanent policy with a fixed premium to make it easier to budget. This is for someone with a stable income and predictable long-term needs. You don’t require control of your investments or wish to have decision making responsibilities with them. You want to leave that in the hands of a financial advisor.

Universal:

A permanent policy with a flexible premium to allow you to make changes based on your current situation. You also have complete control of your investments so make sure that you’re comfortable with managing your investments and acknowledge the risks that come with investing in the market.

Your Life Insurance Needs. Your Choice.

When it comes down to it, you choose what works for your needs. If you want a simple, cost-effective policy that covers the main costs after your death than a term life is likely the best fit for you.

If you look at it as more of an investment than temporary coverage then you’ll want a permanent policy. Choose a whole life policy if you want lifetime coverage that is easy to maintain and depend on. A hands-off approach, if you will. If you want a flexible insurance policy that gives you control of your investments then choose a universal policy. When getting a life insurance policy, it is crucial that you understand the benefits and differences. Contact a financial advisor to make sure you get a life insurance policy that best fits your needs.

Approval #: 20181210A