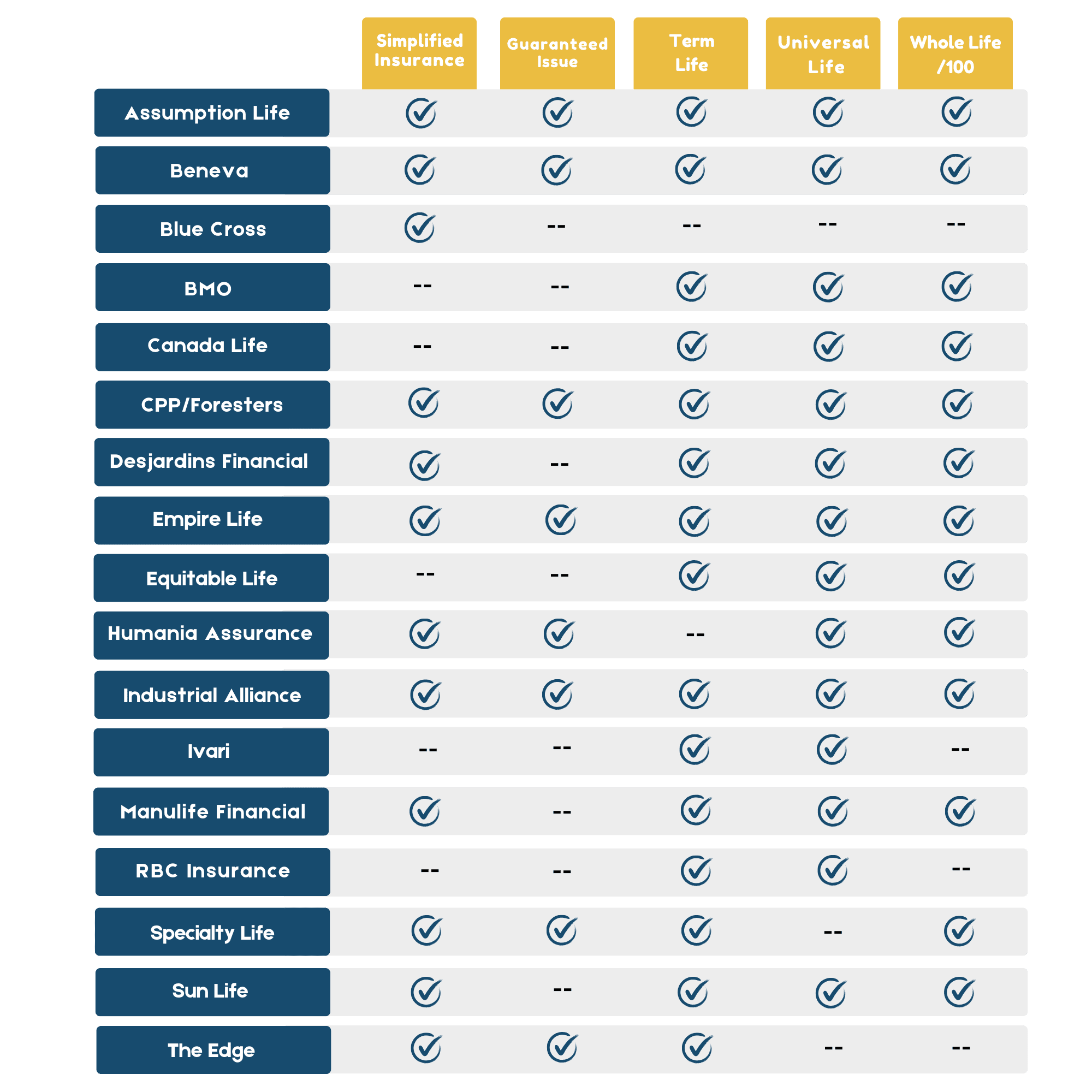

*Life insurance companies and products available in Canada.

Life Insurance

What is the Purpose of Life Insurance?

Life insurance provides financial support in the event of the insured person’s death or survival to a specified period. It ensures that there are funds available to cover various expenses and financial obligations. Consider having enough life insurance to cover:

- Funeral Expenses: Covering the cost of your funeral and related services.

- Notary and Executor Fees: Paying the fees for the notary and executor of your will.

- Taxes on Death: Upon death, most of your assets are considered sold, which may incur taxes. However, the payout from life insurance is always tax-free.

- Debts: Settling any outstanding debts such as credit cards, mortgage, and personal loans.

- Children’s Education: Ensuring funds are available for your children’s education.

- Savings Strategy: Supporting long-term savings goals for your beneficiaries.

It’s important that the life insurance amount is sufficient to allow your beneficiaries to maintain their standard of living. The insurance premiums should be affordable within your budget. With various types of life insurance available, you can find one that suits your specific needs.

Types of Life Insurance

Term Life Insurance: Provides coverage for a specific period (e.g., 10, 20, 30 years). If the insured dies within this term, beneficiaries receive the death benefit. It’s generally more affordable.

Whole Life Insurance: Offers lifetime coverage with fixed premiums. It also includes a savings component that builds cash value over time.

Universal Life Insurance: Combines lifetime coverage with flexible premiums and an adjustable death benefit. It also accumulates cash value based on market interest rates.

Variable Life Insurance: Provides lifelong coverage and allows policyholders to invest the cash value in various investment options, like stocks and bonds. The death benefit and cash value can fluctuate based on investment performance.

Simplified Issue Life Insurance: Requires no medical exam, only a health questionnaire. It’s quicker to obtain but may have higher premiums and lower coverage amounts.

Guaranteed Issue Life Insurance: Requires no medical exam or health questions. It’s available to most applicants but comes with higher premiums and lower coverage amounts, typically used for final expenses.

Life Insurance FAQ's

Premiums are influenced by factors such as age, health, lifestyle, occupation, and the type and amount of coverage.

Consider your financial goals, budget, dependents, and the length of coverage required. Consulting with a financial advisor can help you make an informed decision.

Yes, many policies allow adjustments such as increasing or decreasing coverage, changing beneficiaries, or converting term policies to whole life policies.

Policies usually have a grace period. If you miss a payment, you may have a window to pay without losing coverage. However, repeated missed payments can lead to policy lapse.

Generally, the death benefit paid to beneficiaries is tax-free. However, any interest earned on the death benefit after the insured’s death may be taxable.